The Organisation for Economic Co-operation and Development (OECD) on Monday bashed Colombia’s tax system for being inefficient and benefiting the rich while discouraging investment and job creation.

To improve this, the OECD advised the South American country to impose dividend and carbon emission levies, while easing the tax burden on private enterprises.

Colombia is currently seeking approval to join the OECD, an economic organization consisting of 34 member nations, the majority of which in Europe.

Survey findings

“Productivity and investment outside oil and mining remains subdued, due to a high tax burden on corporations and labor, inadequate infrastructure, and limits to access to finance,” the OECD said.

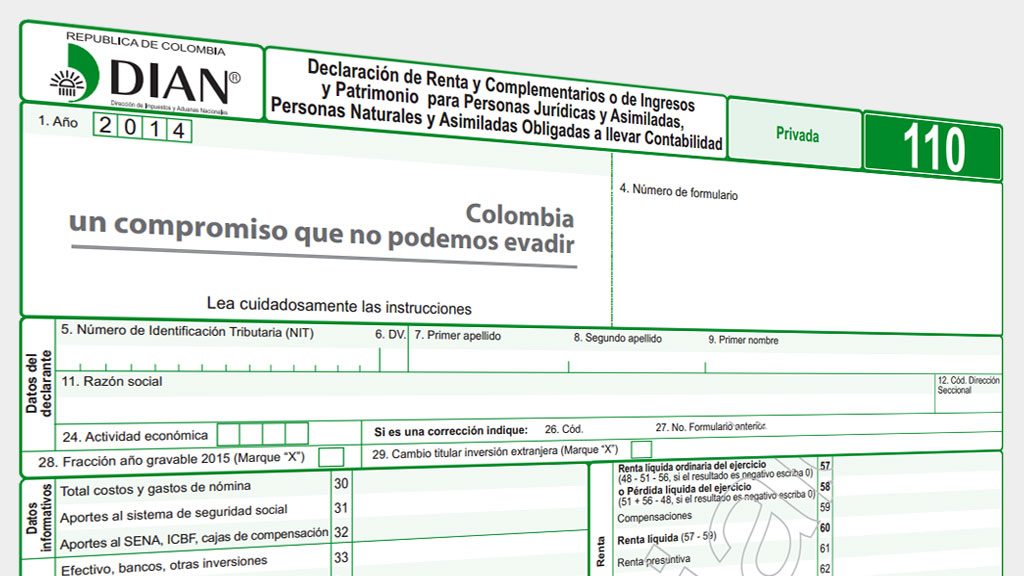

“The Colombian tax system does not promote efficiency and fairness and is very complex,” the survey continued.

Increasing tax revenue will be “critical,” as the government aims to bolster educational and health spending at the same time as oil prices are slumping, the OECD said.

Colombia could increase tax revenue whilst making its system fairer by enacting a dividend levy and reducing tax breaks on mortgages and pensions favoring the wealthy, according to the study.

The country could also boost fuel and environmental taxes, currently representing just 3.6 percent of total tax revenues, over 2 percent lower than the OECD average, the survey stated.

OECD Membership

The OECD is a French based international economic organization geared towards advising and stimulating economic progress and world trade. Colombia is currently seeking membership of the organization.

The OECD currently has 34 member nations.

An approval by the OECD would see Colombia become the third Latin American in the organisation, alongside Mexico and Chile.

Colombia’s Congress recently approved a tax reform that seeks to impose a wealth tax in order to curb perceived excessive disparities in wealth.

MORE: Colombia’s congress approves wealth tax

Sources